This substantial purchase underscores MicroStrategy's strategic positioning in the volatile cryptocurrency market, even as the company navigates investor apprehensions stemming from its recent equity sales.

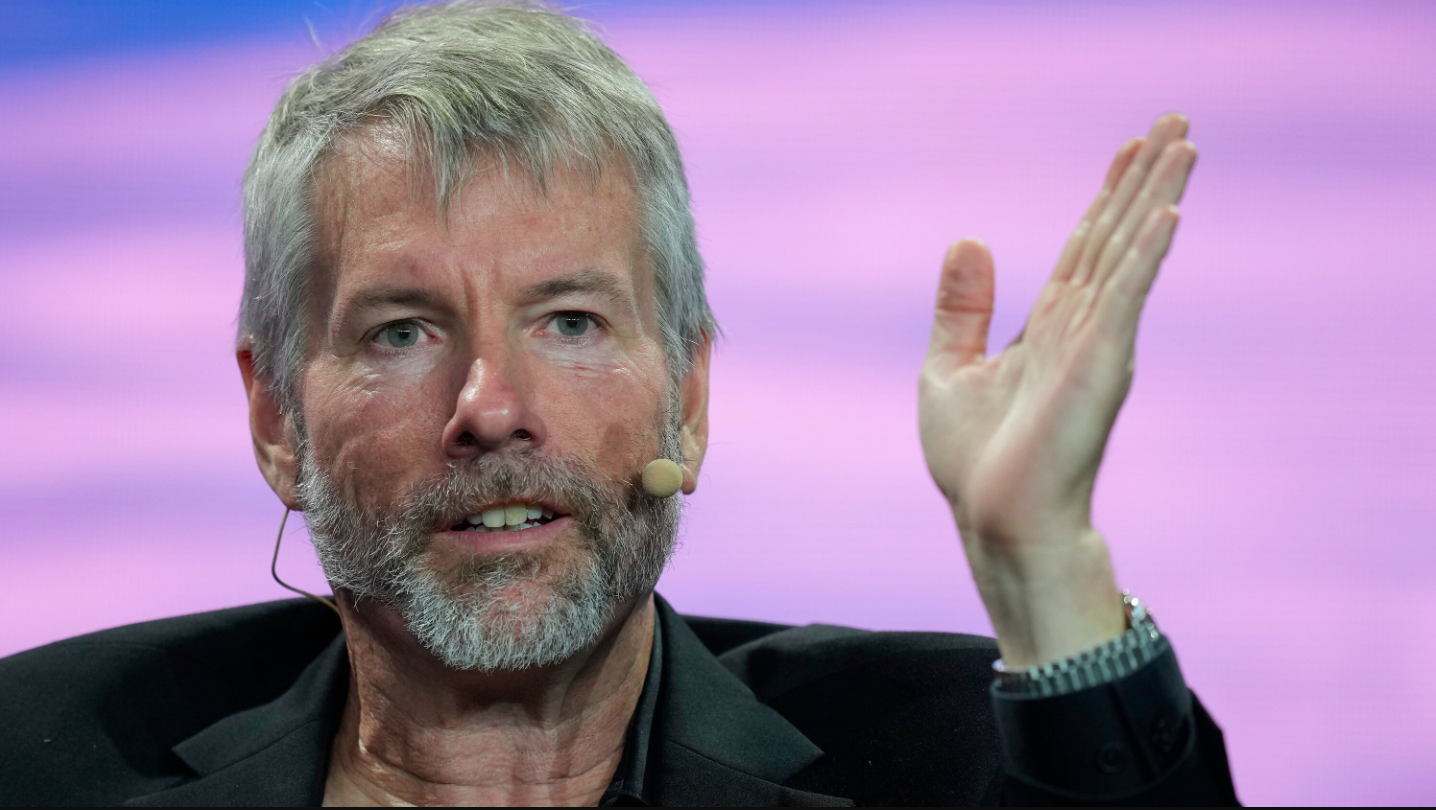

A Strategic Bitcoin AccumulationFounded by Michael Saylor, MicroStrategy has long been a staunch advocate for Bitcoin, viewing it as a superior store of value compared to traditional fiat currencies. The company's aggressive accumulation strategy began in 2020 and has since positioned it as the largest corporate Bitcoin holder globally. The latest purchase of 5,262 BTC not only increases MicroStrategy's cryptocurrency reserves but also signals confidence in Bitcoin's long-term potential despite market fluctuations.

Funding the Acquisition Through Equity SalesThe recent Bitcoin acquisition was primarily financed through equity sales, a decision that has sparked concern among investors. By issuing new shares, MicroStrategy raised substantial capital to fund its cryptocurrency investments. While this approach provides the necessary liquidity to expand Bitcoin holdings, it also dilutes existing shareholders' equity, potentially impacting stock value and investor returns.

Investor Concerns:

Bitcoin's notorious price volatility presents both opportunities and challenges for MicroStrategy. While significant price surges can amplify the value of the company's holdings, sharp declines may erode asset values and impact financial performance. MicroStrategy's steadfast investment in Bitcoin reflects a belief in its digital asset's resilience and potential for substantial appreciation over time.

Key Considerations:

Despite the inherent risks, MicroStrategy's expanding Bitcoin portfolio solidifies its status as a pioneering corporate entity in the cryptocurrency space. The company's unwavering dedication to Bitcoin investment distinguishes it from traditional corporations, positioning MicroStrategy as a leader in digital asset adoption.

Benefits of a Robust Bitcoin Portfolio:

Following the announcement of the latest Bitcoin purchase, MicroStrategy's stock experienced a slight decline, reflecting mixed investor sentiment. While the expansion of Bitcoin holdings is seen as a bold and forward-looking strategy, concerns over equity dilution and increased exposure to cryptocurrency volatility have tempered enthusiasm.

Factors Influencing Stock Performance:

MicroStrategy's continued investment in Bitcoin signifies a strong belief in the digital asset's future, positioning the company to potentially reap substantial rewards as Bitcoin matures and gains broader acceptance. However, the path ahead is not without challenges. Balancing aggressive cryptocurrency investments with maintaining shareholder value and navigating market volatility will be crucial for MicroStrategy's sustained success.

Future Strategies:

The blockchain industry has grown exponentially, disrupting traditional markets and creating new opportunities for innovation.

MoreThe UAE has amassed $40 billion in Bitcoin, solidifying its ambition to become a global cryptocurrency hub.

MoreAustralian Computer Scientist Craig Wright Found in Contempt by UK High Court

MoreIn a bold move reinforcing its commitment to cryptocurrency, MicroStrategy announced the acquisition of 5,262 bitcoins for $561 million, elevating its total Bitcoin holdings to an impressive 444,262 BTC, valued at approximately $42.1 billion.

More