Infosys Associate Vice President and Senior Principal Technology Architect, Peter Loop, has revealed the Blockchain developments to watch out for this year.

\r\nIn 2017, a number of companies began exploring Blockchain’s use within their business, such as Microsoft and IBM. In October, Oracle also revealed a brand-new development, and SAP had its own offering. However, Loop believes that this is only the start. He says that a number of government organisations are investigating the advantages of Blockchain technology, and a selection of entrepreneurs are seeking ways in which the tech can be utilised with smartphones and apps.

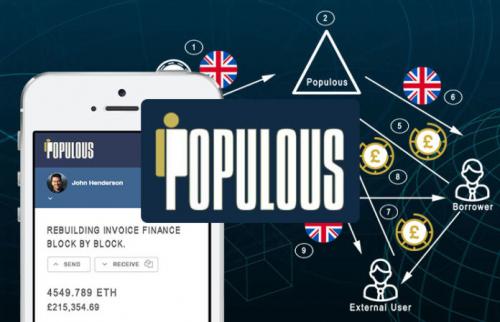

\r\nPeter predicts that the Middle East and Asia will push Blockchain. Interest in the technology is high and banking institutes within these areas have started assessing a Blockchain technology that could mean same-day international money transfers, reducing costs by 30%. Platforms like Populous for invoice discounting, and DTCO for supply chain tracking is also likely to push the tech to the forefront.

\r\nFurthermore, Peter envisages that cybersecurity will appear with specific defenses designed for cryptocurrencies. He also commented that the two most likely sectors to investigate Blockchain technology will be finance and insurance, and said that despite Jamie Dimon’s previous comments which dismissed cryptocurrencies, JPMorgan will open a trading a desk.

\r\nConcluding his opinion piece, Peter stated privatisation and automation of processes should be expected; however, he also said that this won’t slow down cryptocurrency growth.

The blockchain industry has grown exponentially, disrupting traditional markets and creating new opportunities for innovation.

MoreThe UAE has amassed $40 billion in Bitcoin, solidifying its ambition to become a global cryptocurrency hub.

MoreAustralian Computer Scientist Craig Wright Found in Contempt by UK High Court

MoreIn a bold move reinforcing its commitment to cryptocurrency, MicroStrategy announced the acquisition of 5,262 bitcoins for $561 million, elevating its total Bitcoin holdings to an impressive 444,262 BTC, valued at approximately $42.1 billion.

More